The term “diversification” is often heard but not always fully understood. Proper diversification of investments can help investors minimize risk and volatility in their portfolio, while maximizing returns. Diversification is more than avoiding too many eggs in one basket. Rather, diversification is ensuring the right amount of eggs are divided among the right baskets.

Click below to download a free PDF chart that illustrates the Power of Diversification from 2002 through 2021.

There are multiple areas in the market in which investors can invest their dollars.

- Stocks enable investors to benefit when a company’s stock price goes up. Investors can buy a share of a company’s stock. If the stock price goes up, the value of that share will increase.

- Bonds enable investors to loan money to an organization. Investors receive interest payments from that organization. At the end of the loan period (aka maturity date), the investors can get their principal back.

- Commodities enable investors to benefit when certain precious metals, raw materials, or agricultural products go up in value.

- Real Estate enables investors to benefit from wholly or partially owning income-producing properties.

Stocks can be further classified by the size of the company. There are large-, medium-, and small-sized companies. We calculate market capitalization by taking the stock’s share price multiplied by the total number of outstanding shares. Market capitalization is also known as ‘market cap’. Generally:

- Large Cap is a company with a market cap of more than $10 billion.

- Mid Cap is a company between $2 billion and $10 billion.

- Small Cap is a company with a market cap of less than $2 billion.

We also segment stocks into value stocks or growth stocks.

- Value stocks have stock prices that tend to be lower relative to the book value of the company (also known as the price-to-book ratio).

- Growth stocks have a higher price-to-book ratio and higher forecasted growth.

We classify stocks further based on the location of company headquarters:

- Domestic stocks are traditionally headquartered in the United States.

- International stocks are traditionally headquartered outside of the United States.

- International stocks also have a separate segment called ‘emerging markets’. This segment includes companies headquartered in countries that are less developed.

Bonds can be further classified by type, such as Treasuries (U.S. government bonds), Corporate Bonds, or Municipal (local government) Bonds. Bonds can also be classified by duration, or remaining time to maturity. In general:

- Short-Term bonds have maturities of 1-5 years.

- Intermediate-Term bonds have maturities of 1-10 years.

- Long-Term bonds have maturities of greater than 10 years.

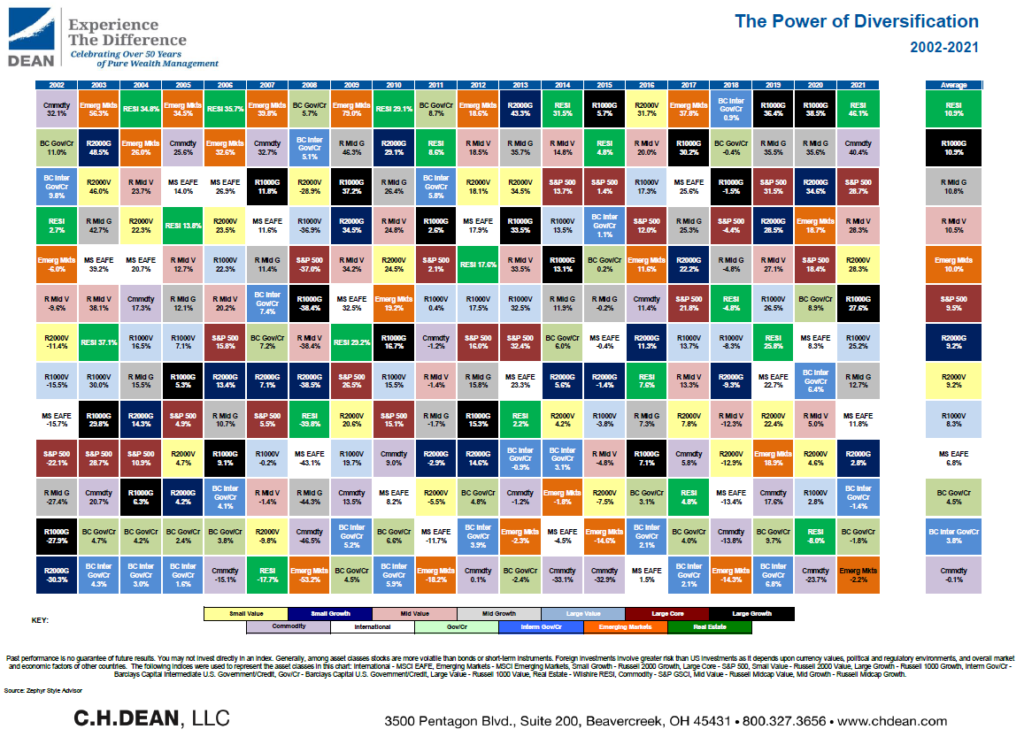

All these different segments are called ‘asset classes’. The above chart tracks how these different asset classes performed historically over the last 20 years. Each asset class has its own color on the chart. For example, in the year 2002, the commodities asset class did the best and the small growth asset class did the worst.

The first big takeaway is that no single asset class is a clear winner every year. There is no asset class in the market into which a person can invest and expect that it will perform the best every year. The best-performing asset classes are historically random and unpredictable. If we look more closely, we see certain parts of the market can do well one year and poorly the next. Looking again at the year 2002, the Commodities asset class was the top performer. But the very next year, it was one of the asset classes with the worst overall performance.

With this chart, you can see the power of diversification. Proper diversification entails dividing dollars among multiple unrelated asset classes because different investments will respond to changes in the market differently over time.

At Dean, we take pride in our disciplined approach to investing. We believe that diversification makes the entire portfolio much stronger when changes in financial markets test our clients’ plans throughout their lifetimes. By investing in different asset classes, our goal is to help clients take advantage of multiple asset classes over time while also ensuring they never assume more risk than is necessary. This protection is designed to help our clients live the life they envision for themselves and their families, today and into the future.