When it comes time to invest in the stock market, it pays to have an investment plan and stick with it.

It can be tempting to try to time investments in the market to avoid downturns, but it is hard to time it right. Timing the market perfectly and putting that money to work at the market’s bottom year after year would be a fine strategy indeed – though, pulling it off is about as likely as winning the lottery.

A more reasonable approach would be to consider initially investing the full amount immediately, or even smaller amounts over time, otherwise known as dollar-cost averaging.

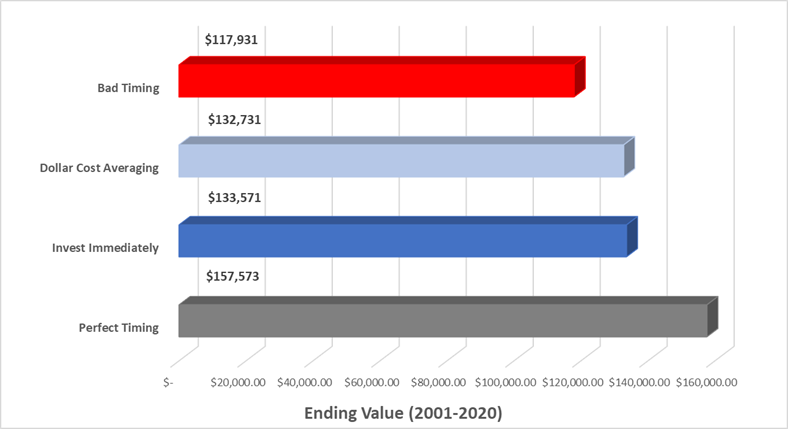

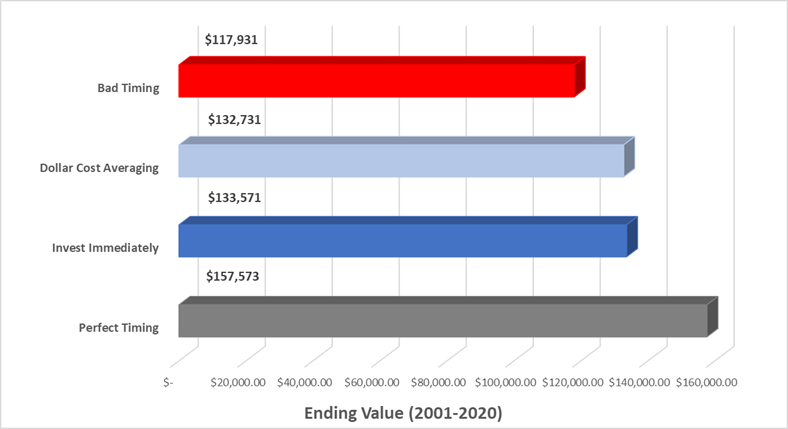

The graph below shows the ending account values of four hypothetical investors who start each year with $2,000 to invest over a 20-year run.

A hypothetical $2,000 annual investment of S&P 500 over a 20-year period (2001-2020)

Source: C.H. Dean. Hypothetical account values represent an investment in stocks that track the S&P 500 Index, an unmanaged index that is generally considered representative of the US stock market. It is not possible to invest directly in an index, and past performance is no guarantee of future results.

Perfect timing means investing the full $2,000 at the lowest daily close each year.

Investing immediately means investing the full $2,000 at the earliest possible opportunity each year.

Dollar-cost averaging means dividing the annual $2,000 allotment into 12 equal portions and investing at the beginning of each month.

Bad timing means investing the full $2,000 at the highest daily close each year.

Dividends and interest are assumed to have been reinvested, and the examples do not reflect the effects of taxes, expenses, or fees. Had fees, expenses or taxes been considered, returns would have been lower for each example. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Periodic investment plans (dollar-cost-averaging) do not ensure a profit and do not protect against loss in declining markets. Investing involves risk, including loss of principal.

Dean Investment Associates, LLC (“DIA”) and Dean Financial Services, LLC (“DFS”) are each a registered investment advisor with the SEC and wholly owned subsidiaries of C.H. Dean, LLC. Dean Capital Management, also an investment advisor registered with the SEC, serves as the sub-advisor for DIA. Dean Capital Management is an affiliate of C.H. Dean, LLC. Readers should note that staying invested or asset allocation does not guarantee a profit nor eliminate the risk of loss.